Two numbers to drive your SMEs commercial banking strategy

“How do I grow?”. It’s a big question, and one we get asked a lot. There are lots of possible answers; target a new group of customers, better meet a need or be more mentally or more physically available.

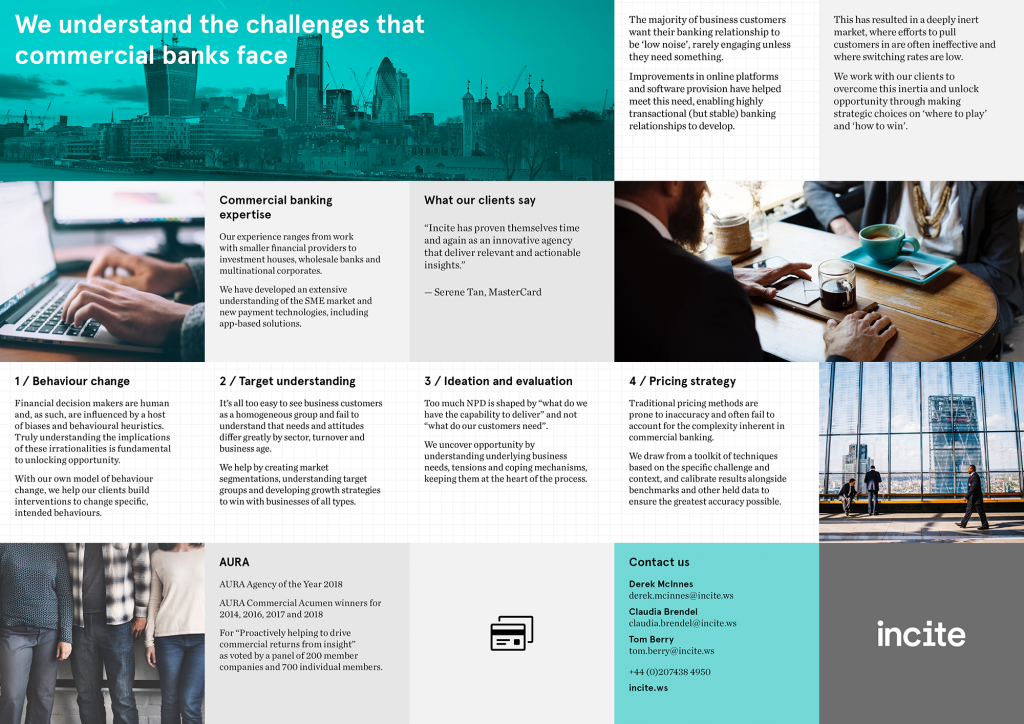

In commercial banking, it’s rarely that straightforward. It’s a market signified by entrenched customers, little impactful innovation and perceived provider homogeneity. As a result, market share figures rarely move.

But we’ve spotted a couple of interesting numbers which can help focus and shape commercial banking strategy: 1% and 200,000.

Let start with 1%

Exact estimates vary, but they all point to the fact that switching rates are incredibly low.

The Current Account Switch Service (CASS) has enjoyed great success encouraging switching of personal current accounts but was used by fewer than 1% of SMEs over the last 12 months.

With the added complexity of payrolls and client and supplier payment systems, switching a business account is more complex and requires a greater time commitment. And clearly reliance on the existing provider for other financial products and liquidity creates another barrier.

Lighten this burden, even if that just means guiding the customer on the actions they need to take. Make it really easy to switch.

200,000 is a much bigger number!

The bigger opportunity likely lies in the 200,000 new small businesses which are formed each year.

This is far higher than the number who switch their business bank account, so it is essential to target this group. An entrepreneur’s first port of call is often their personal bank, and behavioural markers in their personal account (eg a much greater cashflow in and out, and a wider range of payees) can even give hints of a business starting to take shape.

Be ready when they come to you and give them no reason to look elsewhere. Who to bank with is unlikely to be high on their priority list, so deliver a strong call to action and a positive, credible experience to secure them first time.

Making things simple and frictionless can have a huge impact; this is a key reason that relatively new challengers (such as Metro Bank) have been able to succeed among new businesses against far more established competition.

Allow the 200,000 to focus on what’s important

Many commercial banking offers are looking to stand out in a fairly homogeneous marketplace.

This is often done through a suite of ‘added value’ services such as free accounting software or business coaching and seminars.

Businesses, especially new ones don’t want distractions, so consider which will actually resonate and which are just nice to have (will your customers really move to that new accounting system?).

If you have more important things to say, don’t let these shiny add-ons dilute your message. Communicating your brand’s reputation and credibility, or the incredible service you can provide to customers, will always be more important to this group.

The inert 99%

The flip side of low switching is that it’s easy to get a bit complacent. Don’t forget that share can’t be grown if there’s a leak at the bottom of the bucket; keeping customers happy is key. Happy and sticky.

The majority of business customers want their banking relationship to be ‘low noise’, rarely engaging unless they need something. But, supporting them at their ‘moments of truth’ – times where the decisions you take can make or break their business – can create actual, real loyalty. Until then, identify and remove any pain points in the current experience. Execute on the basics perfectly.

So; two numbers and four recommendations: make it really easy to switch, focus on new businesses, give people things that are valuable to their business and be there at the moments of truth. Our outline of a commercial banking growth strategy.

To understand how we help our clients overcome in challenging markets such as this one, please get in touch.