Affluent but disengaged part two: How high street banks can re-ignite interest among younger savers and investors

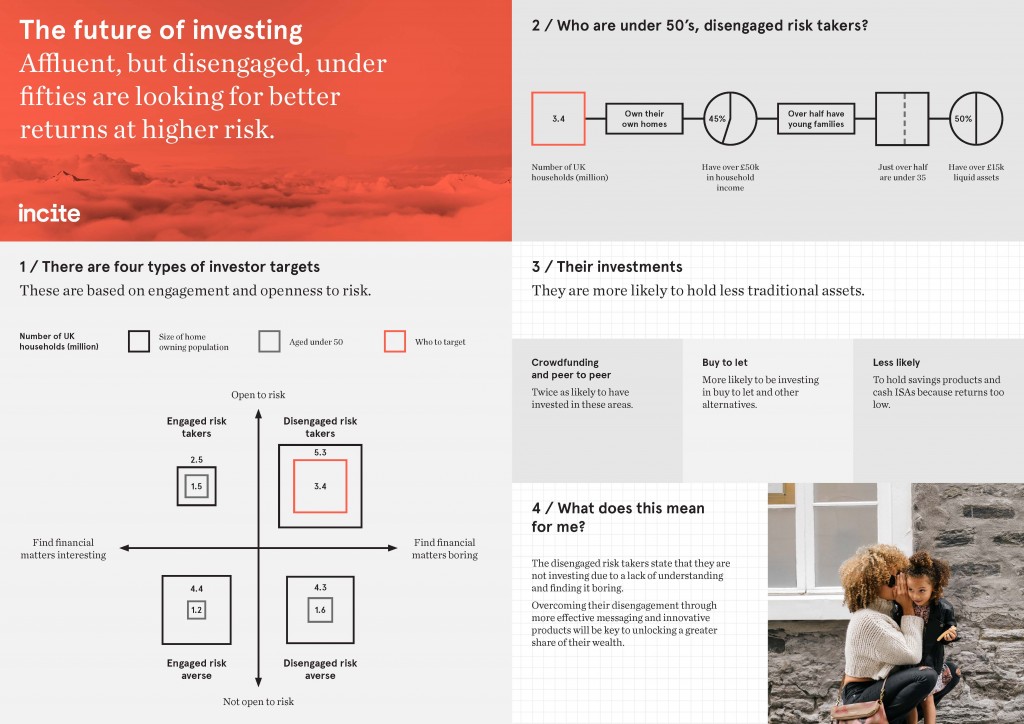

In Part One of this blog we identified 3.4 million homeowners aged under 50 that find financial matters boring, yet claim they would consider high risk investments for greater returns.

They’re particularly important due to their high affluence: 45% have a household income in excess of £50,000, and half have over £15,000 in investable assets. But they’re an untapped opportunity because they are not engaged with financial service providers.

What this means for high street banks

There are two challenges to unlocking this audience’s assets.

Firstly, they don’t really enjoy managing their savings and investments and don’t seek out information, so they’re not always aware of the financial products available to them.

For example, a third of those not considering a stocks and shares ISA say it’s because they’ve never heard of or don’t know enough about it. Simply boosting awareness may go some way to increase product engagement; how that’s done is the key as they’re a resistant, disinterested audience. A new strategy is needed.

And secondly, as they want their money to work hard for them, when selecting a product, they’re turned off by anything that only offers modest returns.

This means that even if we can get more of their attention, we can rule out a number of well-known savings and investment channels as they just don’t appeal to this audience.

They’re not interested in savings accounts with the low rates available in the market, and don’t need their assets sitting where they can get at them easily. They are working full time with a good income, so have enough cash flow to plan for short-term expenditure.

Existing ISAs don’t appeal either. They’re not as tax efficient as they once were – even though the threshold has increased – and people still perceive them to be more complicated than they really are. They’re just dull and won’t deliver a life-changing return.

Finally, this year’s stamp duty changes for second homes has undermined the profitability of the old ‘safe’ haven of buy to let property. With this younger pool of investors, buy to let is less of an option anyway, as they are more likely to have short- to mid-term savings goals – like paying down their main mortgage. So the fact that the return on property investment is now even further into the future makes it much less attractive.

So what can you do?

One clear opportunity is crowdfunding and peer-to-peer lending; a quarter of this segment have invested or are considering in the next 18 months. The challenge for banks is that smaller FinTech companies and start-ups appear more innovative, nimble and emotionally engaging to younger investors.

So keep it simple – any new product or innovation needs to engage the segment, but it needs to be something they can understand and, crucially, associate with.

Be interesting, but simply selling the same products via a different channel will not be enough to engage this group. It needs to look/feel fundamentally different from the traditional investing world.

Offer a good mid-term rate of return to grow appeal. It’s too soon to say, but new Innovative Finance ISA may change this segment’s view on investing, although we still have the same underlying issues as before – awareness and engagement with the category and product.

Lastly, banks have an advantage in being household names so their brand salience will carry (at least some) trust in their products above start-ups and more traditional, less well known investment providers. However, if you are to truly engage this segment, we believe banks will need to be more disruptive in both their product proposition and marketing. It’s a long time since First Direct shook up the banking world, but the time is ripe for something equally different for today’s younger investors.

Find out more

The implication for investment companies in attracting this audience differs greatly from a high street bank, so check back for Part 3 that focusses on both traditional investment providers and newer, innovative challenger brands.

If you’d like to learn more, or discuss how we can help your business unlock opportunity, drop us a line at andrew.powell@incite-global.com or derek.mcinnes@incite-global.com.